Plan Launch Manage Grow… We Are Here To Help!

Learn about starting a business, expanding, or relocating to Sycamore, DeKalb County, Illinois. Below are links to several local, State and Federal agencies/websites that serve as great resources to those who want to start a business or expand. Also, the State of Illinois operates a website – the “State of Illinois Business Portal” which offers guidance to the business community. Remember we are here to help you, just contact our office at office@sycamorechamber.com or call 815-895-3456

Kish College provides resources and tools to small business owners, entrepreneurs and people looking to start a business. From creating a business plan to financial coaching, they will connect you with the resources and people who will bring your business to the next level.

Single state wide resource for entrepreneurs and businesses to obtain regulatory and permitting information. They also offer several grant and loan programs for large and/or growing businesses. Also offers an online resource guide for opening a business in Illinois.

All businesses must register with the Illinois Department of Revenue if you conduct business in Illinois. Includes sole proprietors and exempt organizations. If you will engage in a type of retail sales business, you must have a sales tax number (either an Illinois Business Tax number or a Retailer’s Occupational Tax number). Register and obtain sales tax number at Illinois . Gov.

Provides information and compliance assistance as an employer about worker wages, and State labor and employment laws.

From idea to launching, to managing, to growing the US Small Business Administration has your covered. They also provide grants, financial assistance, contracting opportunities, compliance assistance, counseling, disaster assistance, and on line training.

The SBDC at Waubonsee Community College helps small business owners recognize growth opportunities through planning, promotion and profitability. They help new entrepreneurs assess the viability of their ideas and navigate the steps to getting their business up and running. Their services are no-cost, and provided by experts who have years of experience running a small business.

Corporations and Partnerships require Federal Employer Identification Numbers (FEIN). A Sole Proprietorship may be able to use its Social Security Number. Visit the IRS website to obtain your FEIN.

Provides resources and information to ensure compliance with the U.S. Department of Labor (DOL) agencies.

The Illinois Department of Employment Security is the code department of the Illinois state government that administers state unemployment benefits, runs the employment service and Illinois Job Bank, and publishes labor market information.

~ OSHA Emergency Temporary Standards for the federal vaccine mandate

The OSHA Emergency Temporary Standards (ETS) for the federal vaccine mandate were released on November 5th. Under these new regulations, employers who have one hundred or more employees are required to do the following:

Create a Written Policy on Vaccines for OSHA Review.

The two choices in this policy per the ETS are to require all employees to be vaccinated or do not require vaccines but then require weekly negative test results and mask-wearing (while at the workplace) for those who choose not to be vaccinated.

Note: Employers are not required to pay for testing or face coverings. However, there are local resources available for group testing, etc. Please reach out to the NACC for more information.

Obtain Acceptable Proof of Vaccination Status from Each Employee.

These records are to be maintained and open for OSHA review. Employers must provide up to four hours of paid time off to workers to get vaccinated and to allow for paid leave to recover from any side effects experienced following each primary vaccination dose. Employers may not require employees to use personal time or sick leave to get vaccinated.

Also included in the ETS are health protocols when an employee tests positive for COVID. However, regardless of vaccine status, the ETS does not require employers to provide paid time off during the required time away from the workplace should an employee test positive.

How to Determine Employee Count?

Employee counts are “firm or company-wide” i.e., company not location. Franchises will be considered separately, BUT cumulatively for an individual company holding several franchise locations – and provides options for compliance. Employers must include all employees across all their U.S. workplaces, regardless of employees’ vaccination status or where they perform their work. Part-time employees and temporary and seasonal workers do count toward the total number of employees if they are employed while the regulations are in effect.

Vaccination status is not considered when counting the numbers of employees. For example, if an employer has two hundred employees, all of whom are vaccinated – that employer would be covered.

Penalties.

Employer penalties for non-compliance with OSHA’s rule could include fines based on the number of violations and range up to $13,653 for a single violation. Fines up to $136,532 may be imposed for employers who willfully violate standards. However, depending on the version of the federal budget bill that gets passed, these set fines could be increased exponentially. OSHA officials state they plan to conduct regular inspections.

While this mandate is being challenged in courts, employers should be prepared to comply with the OSHA ETS until the court rulings on the legalities of these mandates are identified. According to OSHA officials, these regulations will be in effect for six months and OSHA will continue to monitor trends in COVID-19 cases in making this determination.

Resources for More Detailed Information:

- For the U.S. Department of Labor FAQ go to https://www.osha.gov/coronavirus/ets2/faqs

- For the Federal Register of OSHA Regulations go to https://www.federalregister.gov/documents/2021/11/05/2021-23643/covid-19-vaccination-and-testing-emergency-temporary-standard

~ SMALL BUSINESS ADMINISTRATION’S (SBA) ISSUES FIRST SET OF GUIDELINES FOR THE RESTAURANT REVITALIZATION FUND.

The SBA has issued the first set of guidelines for the program including: program details, who can apply, how to apply, application timeline, allowable uses of funds, and funding amounts.

~ CHANGES TO PPP AND INCREASED LENDING TO SMALL BUSINESSES

The Biden-Harris Administration recently announced increased lending to small businesses and changes to the Paycheck Protection Program (PPP) to ensure more equitable access to funding. The announcement includes:

- Institute a 14-day waiting period, February 24 through March 9, during which only businesses with fewer than 20 employees can apply for the program.

- Revise the PPP loan calculation formula for sole proprietors, independent contractors, and the self-employed such as home repair contractors, beauticians, and small independent retailers so they can receive more relief.

- Eliminate a restriction that prevents small business owners who are delinquent on their federal student loans from obtaining relief through the Paycheck Protection Program.

This and more information on these changes can be found here.

Additional information regarding the PPP Program and application process can be found here.

~ WHAT SMALL BUSINESSES NEED TO KNOW ABOUT THE NEW PANDEMIC RELIEF PACKAGE – CHANGES TO PPP AND MORE.

As part of an end-of-year pandemic relief package, Congress has passed several changes to the Paycheck Protection Program (PPP) and created a “Second Draw” PPP for small businesses who have exhausted their initial loan. Other changes impact eligibility for initial PPP loans, the loan forgiveness process, and the tax treatment of PPP loans.

Congress has also made changes to other programs – including Economic Injury Disaster Loans (EIDL Program), the Employee Retention Tax Credit, a Venue Grant program, and SBA loan programs –that will benefit small businesses. The following is an update for small business owners:

How Do These Changes Impact My Existing PPP Loan?

I Exhausted My Initial PPP Loan, How Does This Help Me?

What If I Never Received a PPP Loan?

Which Changes to Other Programs That May Help My Small Business Have Been Changed?

~ EEOC UPDATES GUIDANCE ON EMPLOYER COVID-19 VACCINATION POLICIES

The Equal Employment Opportunity Commission (EEOC) has released updated guidance on the responsibilities and rights of employers and employees related to the COVID-19 vaccine, including in cases where employers require employees to be vaccinated.

The publication, “What You Should Know About COVID-19 and the ADA, the Rehabilitation Act, and Other EEO Laws,” includes a section providing information to employers and employees about how a COVID-19 vaccination interacts with the legal requirements of the the Americans with Disabilities Act (ADA), Title VII of the Civil Rights Act of 1964, and the Genetic Information Nondiscrimination Act (GINA).

~ CONGRESS APPROVES $900 BILLION CORONAVIRUS RELIEF BILL

BUSINESS PROVISIONS

PAYCHECK PROTECTION PROGRAM (PPP)

Renewed funding of $284 billion for the Paycheck Protection Program (PPP) to provide forgivable loans to first- and second-time small business borrowers. The bill expands eligibility for nonprofits and includes set-asides for very small businesses and community-based lenders. Second-time loans are limited to businesses with fewer than 300 employees and at least a 25 percent drop in gross receipts in a 2020 quarter compared to the same quarter in 2019. The maximum loan size for second-time borrowers is $2 million. Businesses taking a PPP loan will now be able to take the Employee Retention Tax Credit (ERTC), when previously they were only allowed to opt into one or the other.

PPP loans can be used to pay qualifying expenses, which have been expanded to include expenses such as covered property damage, supplier costs, or worker protection expenditures in addition to employee wages or operating expenses like rent and utilities. When used for qualifying expenses, PPP loans are forgivable. The bill provides a simplified forgiveness application process for loans up to $150,000.

The bill also clarifies that businesses can deduct expenses paid with forgiven PPP loans. This clarification applies to old loans and to new loans and does not include guardrails or limitations. Typically, forgiven debt is considered taxable income. In the CARES Act, lawmakers specified that forgiven PPP loans would not count as taxable income. They also intended that expenses paid for with PPP loans would be deductible but did not specify so in law. Section 265 of the tax code generally prohibits firms from deducting expenses associated with income that is tax-free, so without specification, the Treasury Department ruled that expenses paid for with PPP loans were not deductible. This clarification results in a two-part subsidy to businesses comprised of deductions and tax-free loan forgiveness. Lawmakers intended this two-part subsidy when crafting the CARES Act, and the Joint Committee on Taxation scored the original provision as such. This clarification, a kind of technical correction, does not have a budget impact.

Economic Injury Disaster Loan Program & Small Business Administration (SBA) Debt Relief Payments

It also provides $20 billion for new EIDL grants (economic injury disaster loan program) for businesses in low-income communities, $43.5 billion for continued Small Business Administration (SBA) debt relief payments, and $2 billion for enhancements to SBA lending. An additional $15 billion of dedicated funding is set aside for live venues, independent movie theatres, and cultural institutions.

Employee Retention Tax Credit

Extension and expansion of the Employee Retention Tax Credit through July 1, 2021. The bill increases the refundable payroll tax credit from a maximum of $5,000 to $14,000 by changing the calculation from 50 percent of wages paid up to $10,000 to 70 percent of wages paid up to $10,000 for any quarter. The bill clarifies that businesses will now be able to take the Employee Retention Tax Credit and participate in the PPP.

LOW-INCOME HOUSING TAX CREDIT

Increases allocations to states for the Low-Income Housing Tax Credit (LIHTC). This credit subsidizes the construction and rehabilitation of housing developments that have strict income limits for eligible tenants and their cost of housing.

Employer-side Social Security Payroll Tax Credits

Extension through March 2021 of the employer-side Social Security payroll tax credits to offset paid sick and family leave related to the coronavirus created in the Families First Coronavirus Response Act.

Deduction for Business Meals

Expansion of the deduction for business meals to 100 percent for 2021 and 2022. This will cost about $5 billion in federal revenue.

Tax Extenders

Extension or permanence for temporary provisions known as tax extenders.

OTHER PROVISIONS IN THE $900 BILLION CORONAVIRUS RELIEF BILL

EDUCATION, MEDICAL, NUTRITION, AND TRANSIT RELIEF

$82 billion in funding for colleges and schools, $10 billion in childcare assistance, and Pell Grant expansion

$13 billion to increase Supplemental Nutritional Assistance Program (SNAP) and child nutrition benefits

A ban on surprise medical billing

$63 billion for vaccine distribution, testing and tracing, and other health-care initiatives

$25 billion in rental assistance and extension of the eviction moratorium through January 31, 2021

$45 Million for transit agencies, airlines, airports, state departments of transportation, the motorcoach industry, and Amtrak

To view the 5593 page document click here.

______________________________________________

Business Resources

- Payroll Protection Program Updates

- Paycheck Protection Program FAQ

- Economic Injury Disaster Loan Updates

- Keeping Workers Paid and Employed Act

- Emergency Small Business Grants and Loans Assistance

- Disaster Loan Assistance

- U.S. Small Business Administration (Guidance and Loan Resources)

- Constant Contact Small Business Support Kit

- Small Business Development Center

- Families First Coronavirus Response Act: Questions and Answers

- Families First Coronavirus Response Act: Employer Paid Leave Requirements

LOCAL CHAMBER MEMBER SOURCES

- UPSTAGING, INC., Sycamore – http://www.upstaging.com jspector@upstaging.com (815)899-9888 x 462 — counter & desk shields, table dividers, premium table dividers, premium face shields, and more.

- MED Alliance Group, Inc., Sycamore – http://www.medalliancegroup.com (888) 891-1200 ~ Face Masks (KN95 & Disposable) and Face Shields.

- Sweet Earth, Sycamore — call 815-895-3011 or email friends@sweetearthjewelry.com for details ~ Face coverings (disposable and washable available) and hand sanitizer.

- Lizzy’s Pink Boutique, Sycamore– online only at lizzyspinkboutique.com

Face Masks (washable) - Banner Up Signs, Sycamore — Bannerupsigns.com 815-899-9211 ~ Vinyl signs, floor markers to delineate social distancing requirement, open for business signs, banners, etc.

- HyVee, Sycamore — 2700 DeKalb Ave. Hy-vee.com ~ Hand sanitizer in bulk and individual containers

- OLT Marketing,http://www.hy-vee.com DeKalb — call (815) 901-0569 or email jim@oltmarketing.com

Hand sanitizer, face masks, decals, signage, etc.

- Le Print Express, Sycamore — leprintdekalb.com or email nancy@leprintdekalb.com or call (815) 748-7121 ~ Signage, floor decals, personalized face masks, etc.

- The UPS Store, Sycamore – call 815-787-9500 or email store4801@theupsstore.com Open 7 days a week, signage, floor & window decals, outside signage, print & copy services.

- Christian Connection, Sycamore – call 815-899-3262 ~ face coverings

- Made Just For You, Sycamore – call 815-895-8122 ~ face coverings

- Redeemed Furniture Outlet, DeKalb – 815-758-7619 ~ acrylic frame-less panels, etc.

~~~~~~~~~~~~~~~~~~~~~~~~~

NEWEST INFORMATION

- Downstate Small Business Stablization Program

- Guidance Issued on Payroll Tax Deferral

- Deferring Payroll Tax Executive Order

- IRS Guidance on Deferring Payroll Tax

IL INFORMATION

- Mitigation Guidelines for Region 4

- State of Illinois Coronavirus Website

- Sign up for Small Business Administration Updates

October 2020

ECONOMIC INJURY DISASTER LOANS (EIDLS) FROM THE SBA ARE STILL AVAILABLE.

All Illinois small businesses, small agricultural cooperatives, small aquaculture businesses and private nonprofit organizations affected by Civil Unrest from May 26, through July 30, 2020. Click here to view EIDL Fact Sheet. For current Corona Virus Relief Options click here.

~~~~~~~~~~~~~~~~~~~~~~~

ROUND 2 OF THE BUSINESS INTERRUPTION GRANT NOW AVAILABLE.

ALL municipalities in Illinois may qualify. Your business does not need to be located in a designated DIA (Disproportionately Impacted Area) as in Round 1. In Round 2 eligible businesses include for-profit and nonprofit entities with $20 million or less in annual revenue in 2019 (annualized for businesses that started after January 2019) and experienced losses due to COVID-19. Click here for Eligibility Requirements. Click here to access application.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

SEPTEMBER 24, 2020

Round 2 for the Business Interruption Grants (BIG) are now available to businesses beyond the DIA areas previously listed in Round 1. $220m in grants are available. Sycamore was not listed as a DIA in round 1, however businesses beyond disproportionately impacted areas will qualify this time around. Click on link below for details.

https://www2.illinois.gov/dceo/SmallBizAssistance/Pages/C19DisadvantagedBusGrants.aspx

AUGUST 2020

Governor JB Pritzker announced a package of state grant programs to support communities and businesses impacted by the pandemic and recent civil unrest today. The package includes more than $900 million across more than ten programs and four state agencies. Read more here

The U.S. Small Business Administration, in consultation with the U.S. Department of the Treasury, issued new and revised guidance for the Paycheck Protection Program (PPP). The recent substantive changes made by Congress and the administration to the PPP program will provide borrowers with more flexibility. These changes include:

- Extending the time to spend PPP funds from 8 weeks to 24 weeks

- Lowering the amount that must be spent on payroll from 75% to 60%;

- Extending the deadline to restore FTEs and payroll from June 30, 2020 to Dec. 31, 2020

- Setting the repayment term for loans made after June 4, 2020 at five years.

We have attached the updated U.S. Chamber four-page Guide to PPP Loan Forgiveness. The U.S. Chamber’s guide reflects all of these changes, as well as others made in recent guidance issued by the Department of the Treasury. It is designed to help you more easily understand the forgiveness application process. However, note that while this guide reflects all of the most recent changes, it is possible that further changes could be made. Therefore, we will continue to update you as needed.

Click here for details from SBA and Treasury on the new and revised guidance regarding the Paycheck Protection Program.

~~~~~~~~~~~~~~~~

JULY 2020

The SBA Economic Injury Disaster Loan (EIDL) is Re-open.

The SBA Economic Injury Disaster Loan Program, commonly referred o as EIDL, has re-opened for applications.

The program consists of two parts. An Advance is available in the amount of $1,000 per employee, up to a maximum of $10,000.

This money is in the form of a grant, however, if you apply for/receive Paycheck Protection Program (PPP) funds, the EIDL Advance will be combined with PPP when you apply for forgiveness.

The second part of EIDL is a low interest 3.75% loan. Here are a few things to know about the loan.

- SBA will determine the amount you are eligible to receive. You can request less at loan signing time

- Payments are deferred for 12 months, but interest accrues from the time of funding

- The loan term is 30 years, but there is no prepayment penalty. You can pay back the loan at any time

- The loan can only be used to pay regular working capital expenses. You can’t re-locate, purchase fixed assets, expand your business, or pay off/re-finance debt with this loan

You can apply now at https://covid19relief.sba.gov/#/

~~~~~~~~~~~~~~~~

Paycheck Protection Program Flexibility Act of 2020 was signed into law – PPP enhancement bill was signed into law. This bill modifies provisions related to the forgiveness of loans made to small businesses under the Paycheck Protection Program implemented in response to COVID-19 (i.e., corona virus disease 2019). For details of the bill click here.

The PPP loan forgiveness bill was passed by the Senate.

The bill in summary:

- Extends the PPP loan forgiveness period to include costs incurred over 24 weeks after a loan is issued or through Dec. 31, whichever comes first. Businesses that received a loan before the measure is enacted could keep the current eight-week period.

- Extends to Dec. 31 from June 30 a period in which loans can be forgiven if businesses restore staffing or salary levels that were previously reduced. The provision would apply to worker and wage reductions made from Feb. 15 through 30 days after enactment of the CARES Act, which was signed into law on March 27.

- Maintains forgiveness amounts for companies that document their inability to rehire workers employed as of Feb. 15, and their inability to find similarly qualified workers by the end of the year. Under the modified measure, companies would be covered separately if they show that they couldn’t resume business levels from before Feb. 15 because they were following federal requirements for sanitization or social distancing.

- Extends the deadline to apply for a PPP loan to Dec. 31 from June 30.

- Requires at least 60% of forgiven loan amounts to come from payroll expenses.

- Repeals a provision from the CARES Act that barred companies with forgiven PPP loans from deferring their payroll tax payments.

- Allows borrowers to defer principal and interest payments on PPP loans until the SBA compensates lenders for any forgiven amounts, instead of the current six-month deferral period. Borrowers that don’t apply for forgiveness would be given at least 10 months after the program expires to start making payments.

- Establishes a minimum loan maturity period of five years following an application for loan forgiveness, instead of the current two-year deadline set by the SBA. That provision would apply to PPP loans issued after the measure is enacted, though borrowers and lenders could agree to extend current loans.

Governor’s Phase 3 Business Tool Kit – Click here for details. For Industry definitions and guidelines, please click here

~~~~~~~~~~~~~~~~

The US Chamber has put together a one-stop shop of all the resources you need to reopen your business safely and keep employees and customers healthy and informed. Click here to view.

~~~~~~~~~~~~~~~~

The County will waive First Installment late penalties up until September 3, 2020. The waiver application must accompany the taxpayer’s first installment payment. The waiver application should not be sent separately from the payment. Click here for the waiver.

~~~~~~~~~~~~~~~~

The City of Sycamore has worked to accommodate outdoor dining options for all restaurants, broken into two categories:

- Restaurants and Bars with Private Parking Lots or Existing Outdoor Seating (not located on sidewalks):

- Restaurants and bars will be required to fill out, sign and return the PHASE 3 TEMPORARY OUTDOOR DINING AND LIQUOR PERMIT APPLICATION available on the City website or by contacting BGREGORY@CITYOFSYCAMORE.COM for an application. There will be no fee associated with this application.

- Restaurants and bars must follow the OUTDOOR DINING GUIDELINES FOR RESTAURANTS AND BARS provided by the Illinois Department of Commerce.

- Restaurants without Private Outdoor Space Options

The City of Sycamore will create two outdoor dining areas for restaurant patrons which will open at 3:00 PM on Friday, May 29th. The first area is located on Somonauk Street between Route 64 and Joe Bussone Blvd (the Alley), and the second is located in Parking Lot 4 (located between 7-Eleven and the State Theatre).

- Patrons can order take-out from various restaurants and utilize these areas to eat at.

- Patrons must follow the posted guidelines at the areas, including sanitizing eating area. (Cleaning solution will be provided).

- Restaurants must continue to follow the Outdoor Dining Guidelines for Restaurants and Bars provided by the Illinois Department of Commerce.

- There will be no liquor served or consumed at these areas.

- There is no application or fee to utilize the areas.

- Patrons will be limited to 45 minutes at a table, and no more than 6 people to a table.

- Restaurants must provide restrooms accessible to patrons.

- There will be hand-sanitizer stations and refuse cans available in these areas.

~~~~~~~~~~~~~~~~

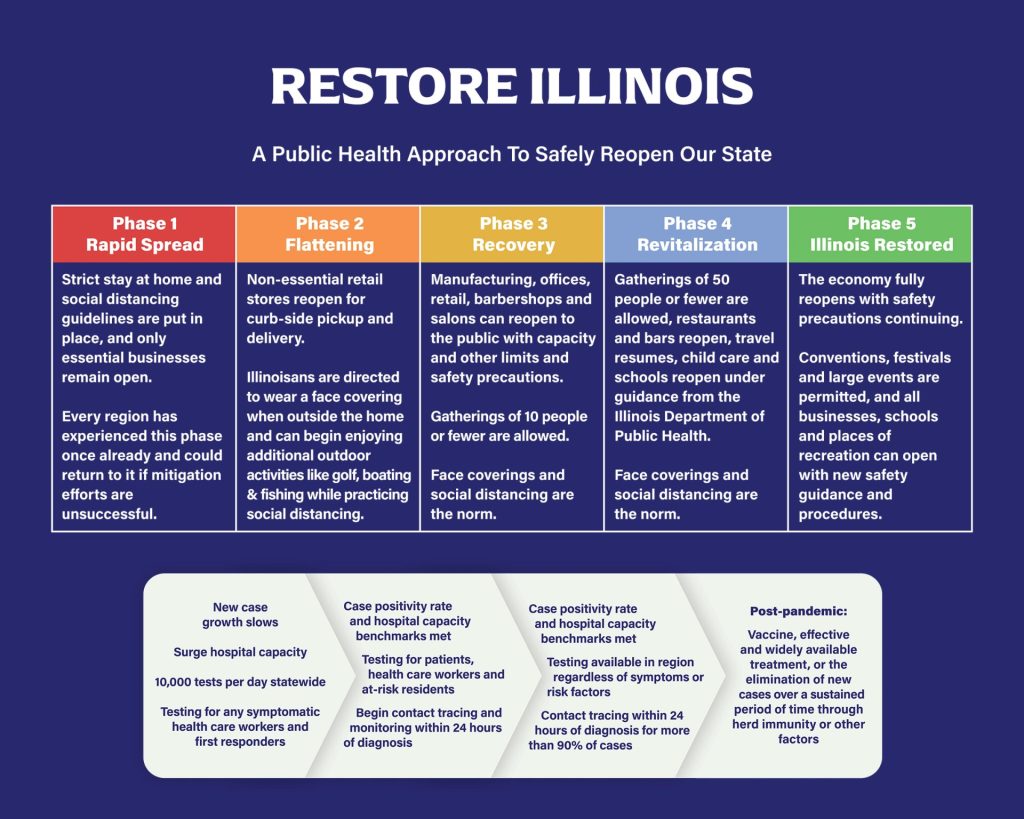

We move into Phase Three of the Governor’s “Restore Illinois” plan on Friday May 29!! In this phase retail stores may open their doors with social distancing guidelines and occupy limits. Contact us to view our Business Reopen Toolkit. This toolkit was created to will help you navigate the new normal and ensure the safety of our community, providing guidance to safely serve your customers and accommodate your employees.

~~~~~~~~~~~~~~~~

The DeKalb County Board approved an ordinance allowing waiver of late fees for first installment property taxes. The waiver applies as long as full payment of taxes is made by the second installment due date and a form available from the county treasurer attesting to current or potential financial need is submitted with the payment. The County will waive First Installment late penalties up until September 3, 2020. The waiver application must accompany the taxpayer’s first installment payment. The waiver application should not be sent separately from the payment.

Applications for the waiver will soon be available on the County website, www.dekalbcounty.org.

~~~~~~~~~~~~~~~~

PLEXIGLASS SAFETY SHIELDS – The City Council has approved a program to provide a plexiglass safety shield to each of our businesses. The shields, made at Upstaging, Inc. right here in Sycamore, will help businesses as they operate with limitations or prepare for reopening under the phased-in Restore Illinois Plan. The program will also help protect residents who visit our businesses. The program provides one shield per business that has a physical operating location in the City of Sycamore and interacts with customers.

The shields are 37 inches tall and 31 inches wide with a cut out at the bottom for business transactions and has legs to stand on their own. To request their shield, businesses should CLICK HERE to complete the application. Please send completed applications to SAFETYSHIELDPROGRAM@CITYOFSYCAMORE.COM.

~~~~~~~~~~~~~~~~

PPP Forgiveness Application – The SBA has released the PPP Loan Forgiveness Application. This document includes a worksheet to calculate your PPP Loan usage, and information on on how to calculate your FTE total.

~~~~~~~~~~~~~~~~

Great news for the small-business community! The Treasury announced today that PPP borrowers with less than $2 million in loans are automatically deemed to have made the financial-necessity certification on the loan application in good faith. Treasury also somewhat softened its rhetoric towards those businesses that have borrowed more than $2 million, noting that while they will not automatically be deemed to have made the certification like the under $2m loans, they can show an “adequate basis” for making the certification under prior SBA guidance based on their individual facts and circumstances. The announcements were issued via FAQ No. 46 https://www.sba.gov/document/support–faq-lenders-borrowers

~~~~~~~~~~~~~~~~

PUA Unemployment is now available for Sole Proprietors and Independent Contractors. You must apply for regular unemployment first, if you have not already done so. Read more information about PUA.

Sam’s Club is teaming up with LISC to offer small business grants. The next round of grants opens on May 14. This program focuses on historically underserved communities – especially enterprises owned by women, minorities, and veterans.

~~~~~~~~~~~~~~~~

~ Last night the DeKalb County Board Finance Committee met and approved an ordinance for waiving late fees on first installment property tax bills for people impacted by the Covid-19 crisis. There will be no penalty if payment for the full amount of taxes is made by the second installment deadline of September 3. The late fee waiver is not automatic; it will require a signed certification confirming Covid-19 impact using a form from the County Treasurer’s office.

~ The ordinance now goes to the full County Board for action on May 20. The Agenda will be posted on May 15th at https://dekalbcounty.org/government/county-boards-commissions/county-board-meetings/ . This meeting will be virtual and as with all County meetings there will be a public comment item on the agenda with a three minute time limit per person.

~ The Illinois Department of Public Health (IDPH) has established a COVID-19 hotline and email address to answer questions from the public; hotline is 800-889-3931 and email is dph.sick@illinois.gov.

~~~~~~~~~~~~~~~~

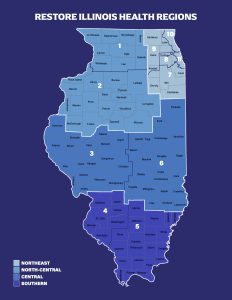

Governor Pritzker Announces Restore Illinois: A Public Health Approach To Safely Reopen Our State. Restore Illinois is a Five-Phase, Regional Plan for Saving Lives, Livelihoods, and Safely Reopening Illinois. Click here to view Restore Illinois One Pager. And click here to view the Full Restore Illinois – A Public Health Approach To Safely Reopen Our State.

~~~~~~~~~~~~~~~~

Agricultural businesses including businesses engaged in the legal production of food and fiber, ranching, and raising of livestock, aquaculture, and all other farming and agricultural related industries (as defined by section 18(b) of the Small Business Act (15 U.S.C. 647(b)) are now eligible for the EIDL and EIDL advance. These businesses would still need to meet the criteria of having 500 or fewer employees. Click here for details about the program.

~~~~~~~~~~~~~~~~

Click here for guidance to plan, prepare, and respond to COVID-19 from the CDC.

April 30

Click here for Governor’s Updated Proclamation. Visit J.B. Pritzker’s CORONAVIRUS.ILLINOIS.GOV, a website dedicated COVID-19 with news, prevention tactics, and more.

April 29

We have compiled best practices and resources to assist owners and employees as you prepare to reopen your businesses.

April 27

What is the Employee Retention Credit?

The Employee Retention Credit is a fully refundable tax credit for employers equal to 50 percent of qualified wages (including allowable qualified health plan expenses) that Eligible Employers pay their employees. This Employee Retention Credit applies to qualified wages paid after March 12, 2020, and before January 1, 2021. The maximum amount of qualified wages taken into account with respect to each employee for all calendar quarters is $10,000, so that the maximum credit for an Eligible Employer for qualified wages paid to any employee is $5,000. Frequently asked questions click here.

April 26

Click here to review Constant Contact Small Business Support Kit

April 24

Click here to view the DeKalb County PTAX-761 form. This form is a request for reduction of assessment of property taxes due to destruction. This may give some relief because destruction includes a denial of customary use. If you have any questions please don’t hesitate to contact Doug at 815-895-7142 or email Djohnson@DeKalbCounty.org.

April 23

Click here to read Gov. Pritzker’s Announcement on the Modified Stay at Home Order

Starting May 1:

~ Non-essential retail businesses may reopen for online orders and curbside pick-up

~ Greenhouses, garden centers and nurseries may reopen as essential businesses, but must adhere to social distancing guidelines.

~ State Parks can reopen

~ Golf permitted under strict safety guidelines.

~ Hospitals can begin scheduling elective surgeries.

To view current social distancing guidelines refer to section 15 of Executive Order Number 8 click here.

April 17

Programs for specific business types:

~ Samuel Adams Restaurant Strong Fund

About: https://www.restaurantstrong.org/about/index.html

Application: https://thegreghillfoundation.submittable.com/submit/163383/restaurant-strong-grant-application

~ Arts for Relief Fund

https://artsforillinois.org/donate-and-apply

~ Beauty Professionals

https://beautychangeslives.org/horst-rechelbacher-foundation-covid-19-relief-grant/

~ Tax Relief

https://www.irs.gov/coronavirus-tax-relief-and-economic-impact-payments

~ NEW! Independent Contractor’s Guide to CARES Act Relief

Click here to view the new Independent Contractor’s Guide to CARES Act Relief. We encourage you to share this new guide with your members.

In addition to the new Independent Contractor’s Guide to CARES Act Relief, we encourage you to continue utilizing and sharing the following items as you see fit:

- Coronavirus Emergency Loans Small Business Guide and Checklist

- Temporary Paid Leave and Family Medical Leave Guide

- Economic Injury Disaster Loan (EIDL) Program Guide

- Employee Retention Tax Credit Guide

- Coronavirus Small Business Guide

- Coronavirus Response Toolkit

April 16

For Illinois updates, click here

For Illinois businesses, click here

For national updates, visit www.cdc.gov/coronavirus

For national business updates, click here

If you have other questions, please call CDPH’s general COVID-19 inquiry line at 312-746-4835, or email coronavirus@chicago.gov

US CHAMBER’S CORONA VIRUS TOOLKIT:

~ Guidance For Employers – Click here to download guidance for employers to plan and respond to the Corona virus.

~ Workplace Tips – For workplace tips and resources for employers to combat the virus, please click here.

~ Corporate Aid Tracker – Click here to view our corporate aid tracker for details on how businesses are helping nationwide.

~ Survey on Business Impact – To view business impact survey results from the American Chamber of Commerce in China, click here.

~ Resilience in a Box – If your business needs help putting a plan in place, click here to use the U.S. Chamber Foundation’s toolkit created in partnership with the UPS foundation.

~ More Resources – For more resources, including consolidated, business-specific guidance from the Centers for Disease Control and Prevention (CDC), please click here.

April 9

As our community takes preventive measures to reduce the spread of COVID-19, more of our businesses are allowing their employees to work remotely. It’s important to understand how this situation may affect your cyber security hygiene. As with most significant global events, cyber criminals will leverage the event against potential targets to advance or achieve a malicious goal. Please take a moment to read this information.

April 8

All employers should be implementing strategies to protect their workforce from the coronavirus while ensuring continuity of operations.

Created by the U.S. Chamber of Commerce, these guides are based on information provided by the CDC, to help employers and employees prepare for and address the effects of the coronavirus.

- Coronavirus (COVID-19) Workplace Tips for Employees (PDF)

- Guidance For Employers To Plan and Respond To Coronavirus (PDF)

April 7

This was just posted today from the Illinois Department of Employment Securities. The direct link to the IDES document Federal-Stimulus-FAQ

How will this affect Illinois unemployment benefits?

For weeks of unemployment beginning March 29, 2020, and ending July 31, 2020, individuals receiving unemployment benefits will receive $600 more than they would receive in their weekly benefit amount. In many cases, individuals will also be eligible for more weeks of unemployment above the 26 weeks provided under regular unemployment rules. Both of these benefits will be applied automatically if you qualify.

April 6

COVID-19 Response Grant – Organizations are invited to apply for DeKalb County COVID-19 Response Grants. This process is for distributing grants that address preparedness, response, recovery, and/or rebuilding efforts. Grant requests will be due by Wednesday, April 8 at noon. The DeKalb County COVID-19 Response Fund (DCCRF), a component pass through fund within DeKalb County. Community Foundation (DCCF), was created in collaboration with various local funding partners. The Fund’s purpose is to be a depository for contributions intended to respond to the effects of COVID-19 in DeKalb County by distributing grants that address preparedness, response, recovery, and/or rebuilding efforts. Click here for Grant_Guidelines and here for an Application

April 4

Sycamore and Genoa businesses may apply for the Downstate Small Business Stabilization. It has been established to provide working capital funds to community’s businesses economically impacted by the COVID-19 virus. For a list of Downstate Small Business Stabilization Program FAQs.

The program component makes funds available for 60 days of verifiable working capital up to a grant ceiling of $25,000 and is available for businesses that employ 50 people or less. Number of employees includes the business owner(s). These funds may be used to assist private for-profit small retail and service businesses, or businesses considered non-essential by the Governor’s Executive Order without the ability for employees to work remotely. Click here for details.

April 3

~ Please see the Paycheck Protection Program Guidance (PPP Memo from DCEO 040220) that we received from the Illinois Small Business Development Center at Waubonsee Community College this morning.

~ The banks listed below are our members that have informed us that they are SBA Approved Lenders. Please contact one of them for more information on the CARES Act/Paycheck Protection Program.

Resource Bank — visit resourcebank.com

First National Bank — visit FNBO for details

First Midwest Bank — visit First Midwest Bank for details.

First State Bank — visit First State Bank for details

Heartland Bank and Trust Co — visit Heartland Bank for details.

~ Paycheck Protection Program Application

April 2

~ A spreadsheet that compares SBA Coronavirus Pandemic Disaster Loans click here.

~ A guide to SBA’s Economic Injury Disaster Loans

~ U.S. Dept. of Treasury re: payroll tax credits: Employment Retention Credit

March 31

~ What you need to know about the IRS Economic Impact Payments: Click on link below:

Update:https://www.irs.gov/newsroom/economic-impact-payments

March 30

National list of COVID-19 Relief Resources for SMBs

~ The SBA Disaster Loan application is now back to an online application form, and they have significantly streamlined the application. You can now also request an advance. If you haven’t already submitted an application, you can do it here: https://covid19relief.sba.gov/#/

~ SBA lenders are getting set up to handle applications for the Paycheck Protection Program. We have reached out to our local banks and am waiting to hear back to see if they are taking applications.

~ Here are a few FAQ links that we have found helpful:

US Chamber

US Senate Committee on Small Business and Entrepreneurship

~ The City of Sycamore is extending payment dates for hotel/motel taxes, along with several other taxes and licenses, for 60 days to provide some relief to all of our businesses. Please visit the City’s website for updated information regarding COVID-19.

MARCH 28

Our elected representatives came together in a powerful way to provide the much needed relief that American workers and businesses need and deserve during this unprecedented time. Please click here for the loan guide provided by the US Chamber: USChamber Small Business ELA Loan Guide

MARCH 26

Hospitality Emergency Grant Program

To help hospitality businesses make ends meet in the midst of the COVID-19 pandemic, they Illinois Department of Commerce and Economic Opportunity (DCEO) launched the Hospitality Emergency Grant Program with $14 million drawn from funds originally budgeted for job training, tourism promotion, and other purposes. Grant funds are available to support working capital like payroll and rent, as well as job training, retraining, and technology to support shifts in operations, like increased pick-up and delivery.

Hotels and food and beverage businesses can fill out the grant application between March 25th and April 1st. The grants sizes are $10,000, $25,000, or $50,000 and grant winners will be notified on April 4th.

State of Illinois Treasurer Office – COVID-19 Relief Program

MARCH 26

COVID-19 Stimulus passed in the Senate last night. Phase_3_Bipart_Summary_-_Revised

Continue to check links below as they will also be updated on a regular basis.

- Keeping-workers-paid-and-employed-act

- Illinois Department of Employment Security

- Unemployment Frequently Asked Questions

- Interim Guidance for Businesses and Employers (Center for Disease Control & Prevention (CDC)

- Information on COVID-19 (National Center for Disease Control & Prevention (CDC)

- Guidance for Businesses and Employers to Plan and Respond to Coronavirus (U.S. Small Business Administration)

- Business and Organization Guidance (Illinois Department of Public Health (IDPH)

- Information for Businesses (DeKalb County Health Department)

- Workplace Tips for Employees (U.S. Chamber of Commerce)

- COVID-19 Resource Page (Northwestern Medicine)

- Managing your Anxiety about the Coronoavirus. (Edward Health)

- Questions answered (World Health Organization)

- Click here for Important SBA Information

- Dekalb County Health Department

- Illinois State Board of Education – K-12 Education – Coronavirus (COVID-19) Updates and Resources

- Illinois Board of Higher Education – College/University – Coronavirus-19 Updates from Higher Education Institutions

SBA Schedule-Of-Liabilities–2202

MARCH 24

We are currently working with a team of business, municipal, community, and university leaders from throughout the county, DeKalb County UNITES. This grassroots movement focuses on helping small businesses remain viable during this period of mandated restrictions and economic uncertainty.

We have formed Action Teams to address specific areas of challenge and opportunity for small business:

- A marketing/communications team is working to aggregate, amplify and add to the many excellent communications underway from area Chambers of Commerce, DeKalb County Economic Development Corporation, the DeKalb County Convention & Visitors Bureau, and many other area organizations.

- Local restaurateurs are looking at ways to help connect their capacities with the needs of the essential businesses that continue to operate. We will work with restaurateurs to assist in any way possible to keep restaurants afloat, restaurant workers employed and essential employees fed.

- Understanding the needs and capabilities of the larger small business community during this period will be an essential element of our work. With an inventory of small business capabilities, an action team will reach out to larger businesses and institutions to determine how they might direct their purchasing power to smaller, more vulnerable businesses.

- While small businesses try to figure out how to move forward in this new environment, they continue to worry about their people, their payroll, cash flow, debt obligations, taxes and other elements of running their businesses. A financial resources action team will help small businesses navigate financial support that is available to them.

Like everything related to this pandemic, our work is rapidly evolving. As needs become apparent in the community, the team will reassess and develop new strategies for helping small businesses. More information is available online at www.dekalbcountyunites.com

MARCH 23

From the City of Sycamore -please visit the City’s website for updated information regarding COVID-19.

LIQUOR LICENSE UPDATE

Class B and C liquor license holders (Bars and Clubs) are permitted to sell packaged liquor for off premises consumption in accordance with the City Code. Any Class A liquor license holder (Restaurant) wishing to be temporarily allowed to sell packaged liquor for off premises consumption during the COVID-19 pandemic crisis should contact the City at 815-895-4853 for permission.

RESTAURANT & BAR TAX PAYMENT EXTENSION

The City is planning to extend restaurant and bar tax payments for at least 60 days to provide some assistance to impacted businesses. As more information becomes available it will be distributed or please check the City’s website for periodic updates.

We are continuing to explore ways we can provide some level of assistance or relief to our business community.

March 22

SBA ECONOMIC INJURY DISASTER LOANS –

Three_Step_Process_SBA_Disaster_Loans

MARCH 20 – SBA low-interest disaster loans now available

All Illinois small businesses (according to SBA’s size standards) and private non-profits can now apply for loans of up to $2 million through the U.S. Small Business Administration’s Economic Injury Disaster Loan Program. If your business has been affected by the coronavirus pandemic, this program offers working capital to meet needs including payroll, accounts payable, and fixed debt payments until the situation improves. Interest rates are 3.75% for small businesses and 2.75% for non-profits. Apply now at https://disasterloan.sba.gov/ela/.

If you have questions, the Illinois District Office is hosting twice daily webinars on the Economic Injury Disaster Loan program Friday, March . Businesses and other stakeholders can register for these trainings at www.sba.gov/il. These trainings will cover:

- Program eligibility

- Use of proceeds

- Terms

- Filing requirements

- Additional small business resources

Additional Resources

- Information for small businesses affected by coronavirus at sba.gov/coronavirus

- Follow @SBA_Illinois on Twitter.

- Subscribe to email updates at ly/SubscribeIL to stay up to date on SBA news and events.

- SBA resource partners (Illinois Small Business Development Centers, WBDC, SCORE, Veterans Business Outreach Center) stand ready to help. Go to sba.gov/local-assistance to find a counselor or mentor.

Click here to view Governor’s March 20th ExecutiveOrder-2020-10. You can also email Illinois.do@sba.gov or call (312) 353-4528 (Chicago office) or 217-(217) 747-8249 (Springfield office) to talk to a Small Business Administration team member directly.

MARCH 19

- The Presidents Coronavirus Guidelines for AmericaTHE PRESIDDENTS coronavirus-guidance_8.5x11_315PM

- File for Unemployment Benefits: (Illinois Department of Employment Security (IDES)

- Make Your Voice Heard and Take the Survey: (Illinois Department of Commerce & Economic Opportunity

MARCH 17

~ Wednesday, March 17, the Senate passed H.R. 6201, the Families First Coronavirus Response Act. This bill provides, among other things, provisions to address Paid Sick Leave, Paid Family and Medical Leave, and Unemployment Insurance for workers displaced by the ongoing outbreak. Furthermore, it includes provisions to provide diagnostic testing for coronavirus, and bolsters Medicaid and nutrition programs for at risk populations. Click here to see the U.S. Chamber’s summary.

MARCH 16

We will keep you informed and to assist in the ways you need most.

Please let us know if there is anything specific you require and we will do our best to get you the information, resources, or contacts that will help you the most. Contact us via phone 815-895-3456 or email at rtreml@sycamorechamber.com

Stay healthy and keep us in mind as your network, your resource, and your advocate.